by Nicole Ouellette | Apr 3, 2018 | Personal Finance Tips

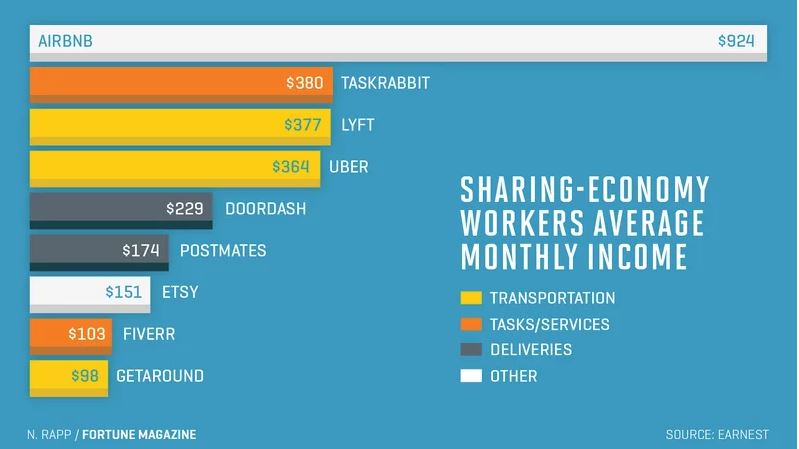

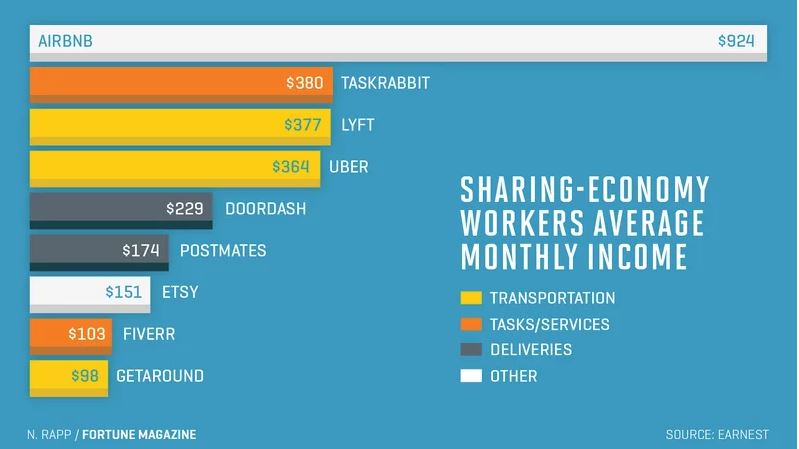

We live in this really weird time in history where there is real life money to be made in the ether (i.e. the internet). I’ve been looking into (and trying) different things over the course of the last few years and I thought it would be fun to do a post about...

by Kassandra Strout | Jun 19, 2015 | Personal Finance Tips, Tech

The ability to send someone money online has been around for a few years now, but there are still interesting innovations being made on a regular basis. There’s crowdfunding apps that we’ve discussed before (GoFundMe and Kickstarter, for example), but even...

by Nicole Ouellette | Jan 13, 2015 | Personal Finance Tips

What I really like about blogs is you make friends you would have never otherwise made. My primary example is British Phil when people ask me for an example but I have also made friends who I’ve never gotten to meet, one of them being Jackie at The Debt Myth....

by Nicole Ouellette | Nov 7, 2014 | Personal Finance Tips

I was reading a statistic that there are 1,409,430 non-profits in the US and 817,379 of them have an operating budget of less than $100,000. I’m guessing this means that most of them don’t have fundraising committees, an on staff donor relations...

by Nicole Ouellette | Oct 21, 2014 | Personal Finance Tips

One of Derrick and my personal goals in life is to get our house paid off early. So after we got married and had cleared out boxes of plates, silverware, and mason jars for the event out of the spare bedroom, it seemed natural to think about using otherwise ignored...

by Nicole Ouellette | Apr 3, 2013 | Personal Finance Tips

About a month ago, I cut up my credit card. I stood at my kitchen counter with my glass of red wine, had a moment of silence and then snipped. My dad had cosigned on this credit card over ten years ago while I was in college so I could build some credit. And build I...